***VIDEO FILE INCLUDED*** Rep. Susie Lee: ‘Betsy DeVos Is More Concerned with Protecting For-Profit Schools than Helping Students Succeed’

CLICK HERE TO WATCH ON YOUTUBE

CLICK HERE TO DOWNLOAD VIDEO FILE

Washington, D.C. – Member of the House Committee on Education and Labor, U.S. Rep. Susie Lee (Nev.-03), questioned Department of Education (DOE) Secretary Betsy DeVos on her department's refusal, since June 2018, to provide full loan relief to hundreds of thousands of student loan borrowers under the Borrower Defense (BD) rule, causing a massive backlog in claims from defrauded borrowers seeking relief.

Secretary DeVos has the authority to provide full and immediate relief to students defrauded by predatory for-profit colleges. However, she and her department have refused to do so even after court rulings, student testimony, and the Education Department's own internal investigations found that hundreds of thousands of defrauded students legally qualify for Borrower Defense relief.

Secretary DeVos continued to tell Congress that she wants to protect taxpayer dollars from fraudulent student loan forgiveness claims. Rep. Susie Lee highlighted that the real threat to the taxpayer is fraudulent for-profit schools, not students who were defrauded by these very schools:

Rep. Lee: You spoke many times today about protecting taxpayer dollars, and I could not agree with you more, yet I'm feeling that a lot of the tension in this room today is because there's concern about protecting taxpayer dollars from frivolous Borrower Defense claims or, like I'd like to focus on, on how do we protect taxpayer dollars from these fraudulent, predatory schools and prevent this from happening before we throw thousands of students into turmoil. So I want to ask you a second question – isn't the point of financial responsibility monitoring to predict school closures before they happen so that something can be done proactively to protect the taxpayer dollars from going to those institutions through student loans?

Sec. DeVos: Well, Congresswoman, let me just say, first of all, I don't think, I think levying a claim of predatory against any school that is organized is –

Rep. Lee: Well, I want to define what fraud means, okay? Because it's been used here a lot today…And so my question was simply yes or no, do you believe that the point of the financial responsibility monitoring is to protect?

Sec. DeVos: To the extent possible, I think that's probably desirable, yes.

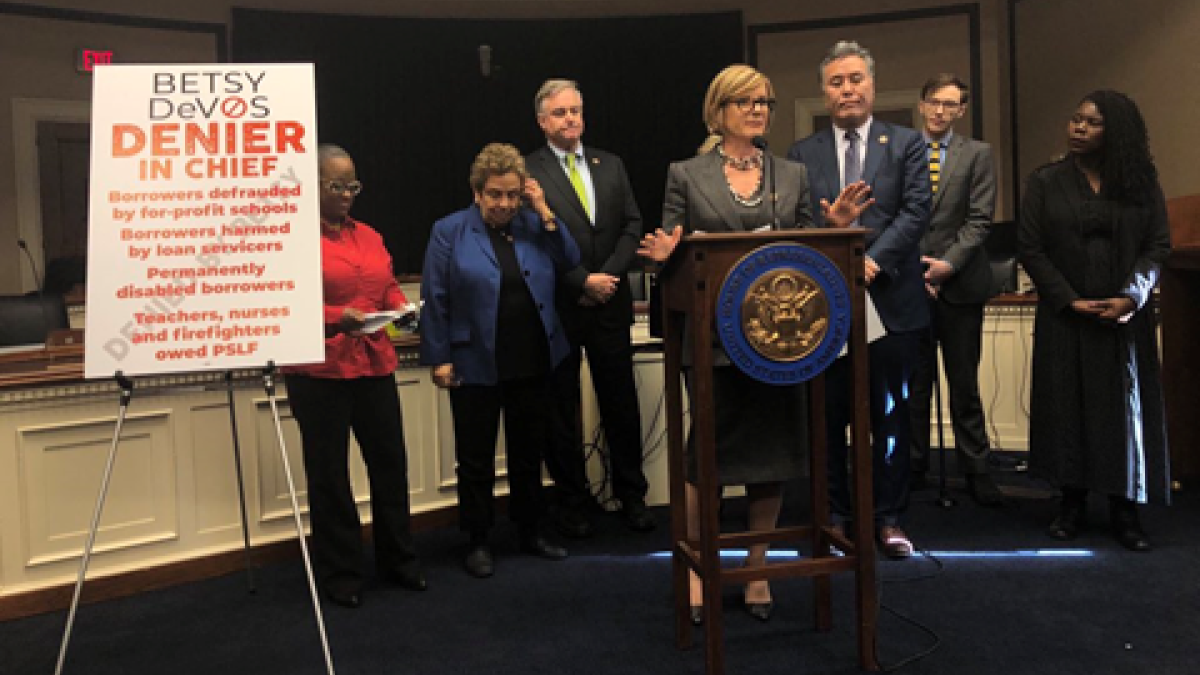

In a press conference after the hearing, Rep. Lee made it clear this hearing is far from Congress' final action to protect student borrowers and hold Secretary DeVos accountable:

"This hearing was an important step in shining a light on the damage that the DeVos-led Department of Education is doing to our country's students. But we are not stopping here.

"We need to overturn Secretary DeVos' 2019 Borrower Defense Rule that weakens oversight over predatory for-profit schools. Rules that make it harder to predict when schools are about to go under, Rules that make it harder—even impossible—for defrauded students to seek loan forgiveness.

"I introduced a resolution in the House—along with Senator Durbin in the Senate—to overturn this harmful borrower defense rule.

"I'm proud to have the support of my colleagues in the Education and Labor Committee and I'm confident that Congress will see the facts, and lend their support too.

"It's time for us to hold Betsy DeVos accountable to students in this country."

BACKGROUND: On Sept. 26, 2019, Rep. Lee and U.S. Sen. Dick Durbin (Ill.) introduced a Congressional Review Act (CRA) resolution opposing Secretary DeVos's rewritten Borrower Defense Rule that gutted essential protections for student borrowers and taxpayers.

History of the Borrower Defense Rule

In 1992, Congress added a provision, known as borrower defense, to the Higher Education Act to give borrowers a legal right to discharge their federal student loans due to misconduct by their institution. In 1995, the Department of Education, at the direction of Congress, promulgated a final rule establishing the criteria for borrowers to receive a borrower defense discharge. The authority was rarely used until the major collapse of predatory for-profit Corinthian Colleges.

As a result of this collapse which left an estimated 350,000 students with worthless degrees and fraudulent student debt, the Department began receiving a flood of borrower defense claims from Corinthian and other students—largely from for-profit colleges. Facing a flood of defrauded borrowers seeking discharges, the Obama Department announced it would enter a negotiated rulemaking to update its 1995 borrower defense rule because it "provided little detail on how borrowers could submit, and how the Department would adjudicate claims."

In October 2016, the Department issued its final borrower defense rule—estimated to provide $17 billion in relief to students harmed by school misconduct and abrupt school closures. Upon taking office, Secretary DeVos delayed implementation of the 2016 rule—delays which a federal judge eventually found to be illegal, and announced an effort to rewrite the rule. In the meantime, the Department has more than 227,000 pending claims from students waiting for relief and, as of December 10, 2019, the Department has not discharged a single borrower defense claim in 18 months.